Introduction to HSBC and Its Global Financial Footprint

HSBC Holdings plc is one of the largest and most recognized financial institutions in the world. Founded in 1865 in Hong Kong and Shanghai, HSBC has built a reputation as a global banking powerhouse with operations spanning across 60+ countries. The bank serves millions of customers through retail, commercial, and investment banking, as well as wealth management. With such a massive international footprint, the HSBC share price often reflects not just the bank’s own performance but also the health of the global economy.

Investors have long viewed HSBC as a bellwether stock for financial stability in both the East and West. Listed on major exchanges like the London Stock Exchange (LSE: HSBA) and the Hong Kong Stock Exchange (HKEX: 0005), the company bridges the world’s two biggest financial hubs. The dual listing provides an interesting dynamic — the HSBC share price in London can sometimes differ slightly from the Hong Kong equivalent, driven by currency fluctuations and market sentiment.

Understanding HSBC’s share price isn’t as simple as looking at daily movements. The bank’s valuation is deeply tied to global interest rates, geopolitical factors, and the shifting balance between Western and Asian markets. This makes HSBC an especially fascinating stock for long-term investors who seek stability mixed with global exposure.

Historical Overview of HSBC Share Price Movements

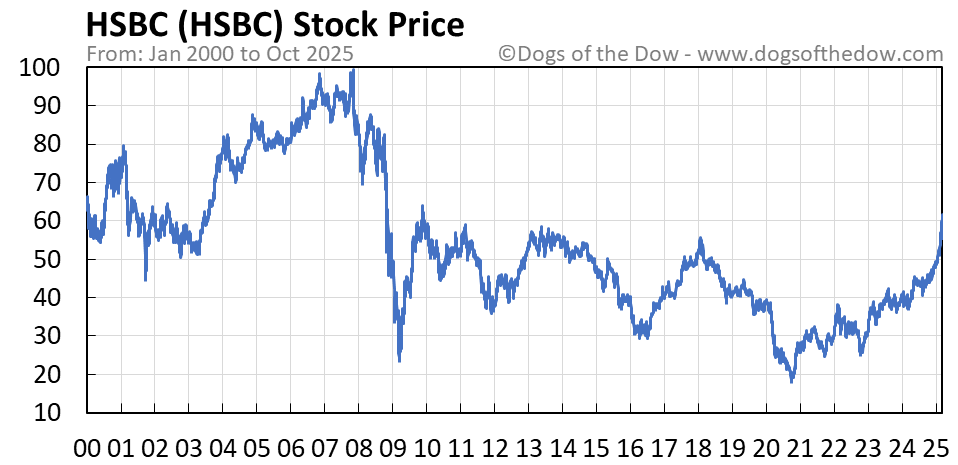

The journey of the HSBC share price over the past few decades tells the story of global finance itself. Back in the 1990s, HSBC was seen as a stable, blue-chip stock with a predictable dividend yield. Its conservative management style and diversified international operations shielded it from the volatility that affected many other financial institutions. However, things took a dramatic turn during the 2008 global financial crisis.

During the crisis, HSBC’s shares fell sharply along with most major banks, but unlike others, it avoided the worst of the meltdown due to its strong capital position and limited exposure to toxic U.S. mortgage assets. The bank emerged relatively strong compared to peers like RBS or Lehman Brothers, which either collapsed or were forced into government bailouts. By the early 2010s, HSBC’s share price began to recover, fueled by the global economic rebound and its expansion in Asian markets.

In more recent years, the COVID-19 pandemic introduced another period of volatility. Global lockdowns, reduced economic activity, and historically low interest rates weighed heavily on banks’ profitability. HSBC’s share price hit multi-year lows in 2020, with dividends temporarily suspended — a rare move that shocked long-time investors. However, since 2021, the recovery has been notable. Rising interest rates across major economies and HSBC’s strategic pivot back toward Asia have helped its share price regain lost ground.

Factors Influencing the HSBC Share Price

The HSBC share price doesn’t move in isolation. It is influenced by a variety of internal and external factors that investors should understand before making decisions. At the heart of these are global interest rates, regulatory conditions, and macroeconomic trends.

Interest Rates and Banking Profitability

Interest rates are arguably the single most important factor influencing bank profitability. When rates rise, banks can charge more for loans relative to what they pay on deposits — this is known as the net interest margin (NIM). For HSBC, which operates in both Western and Asian markets, changes in rates by central banks like the Bank of England, the Federal Reserve, and the People’s Bank of China directly affect its earnings. The post-pandemic era of higher interest rates has boosted HSBC’s profitability, which in turn has supported a recovery in its share price.

Economic Growth and Global Trade

HSBC’s identity as a global bank means it benefits from robust international trade and cross-border transactions. When economies in Asia, Europe, and the U.S. grow, so does HSBC’s lending activity and fee income. Conversely, during economic slowdowns or trade disruptions — like the U.S.-China trade war — investor confidence in HSBC tends to dip, pulling the share price down.

Geopolitical and Regulatory Environment

Another critical factor affecting HSBC’s share price is geopolitics. The bank’s unique positioning between the East and West often places it in the middle of political tensions. For example, increased scrutiny from U.S. regulators, or changes in Hong Kong’s autonomy, can affect investor sentiment. Moreover, strict banking regulations and compliance costs can also pressure profitability, influencing the stock’s valuation.

The Impact of Global Economic Trends on HSBC’s Valuation

Global economic cycles play a significant role in shaping the HSBC share price trajectory. In periods of economic expansion, banks like HSBC thrive due to higher loan demand, stronger consumer spending, and improved business activity. Conversely, recessions or slowdowns tend to reduce loan growth and increase defaults, both of which can weigh on earnings.

Over the last decade, HSBC has had to navigate several challenging global environments. The lingering effects of the European debt crisis, Brexit uncertainty, and trade tensions between China and the U.S. have all created headwinds. However, the bank’s strategic focus on Asia — particularly China’s economic growth — has often acted as a counterbalance to Western slowdowns.

In recent years, HSBC’s decision to double down on Asia has proven prescient. The bank has restructured its operations, exited less profitable markets, and redirected capital toward regions like Hong Kong, Singapore, and mainland China. This move aligns with long-term global economic shifts, where Asia is projected to remain a key growth engine. Investors have rewarded this strategic clarity, and it has reflected positively in the HSBC share price trajectory.

Dividends and Their Effect on the HSBC Share Price

One of the biggest draws for HSBC investors has always been its generous dividend policy. Historically, HSBC has been regarded as a “dividend giant,” offering yields that often exceed market averages. Income-focused investors, especially in the UK and Hong Kong, view HSBC shares as a reliable source of passive income.

However, during periods of financial uncertainty, dividends can come under pressure. The 2020 suspension of dividends during the pandemic was a stark reminder that even the most stable banks can face constraints. While the decision was largely due to regulatory pressure rather than financial weakness, it still caused frustration among shareholders and temporarily affected the HSBC share price.

Since then, HSBC has reinstated its dividends, and payouts have been steadily increasing in line with rising profits. The return of strong dividends has been a key driver behind investor confidence. As interest rates remain elevated, the bank’s profitability has improved, enabling it to maintain healthy distributions. This reinforces the perception of HSBC as a blue-chip stock suitable for both income and capital appreciation.

Comparing HSBC’s Share Price with Other Global Bank

To get a clearer sense of where HSBC stands, it’s useful to compare it to other major international banks. Institutions like JPMorgan Chase, Citigroup, Barclays, and Standard Chartered all provide context for evaluating HSBC’s share performance.

Unlike JPMorgan or Citigroup, which are heavily U.S.-focused, HSBC’s strength lies in its global diversification. The bank’s significant exposure to Asia gives it a growth advantage, especially when compared to European rivals that struggle with lower profitability. On the other hand, HSBC’s complex regulatory and geopolitical exposure can sometimes limit its appeal to investors seeking simpler, more predictable operations.

In terms of share price performance, HSBC often trades at a discount to its American peers — mainly due to regulatory overhead and market sentiment surrounding its dual role in East-West finance. However, that same global reach is also a potential advantage. As Asia continues to grow faster than the West, HSBC’s diversified base could make its shares more resilient in the long run.

Recent Performance and Market Sentiment

As of 2025, the HSBC share price reflects a renewed sense of optimism. Following several restructuring efforts, cost reductions, and improved profitability, investors have started viewing the bank more favorably. The stock’s recovery from pandemic-era lows has been significant, supported by rising interest rates and strong Asian market performance.

Market analysts have generally maintained a positive to neutral outlook on HSBC shares. While some caution that global growth uncertainties could pose risks, most agree that the bank’s balance sheet remains robust. The capital position, measured through the CET1 ratio, remains comfortably above regulatory requirements — a key indicator of financial stability.

Another factor boosting sentiment is the bank’s digital transformation. HSBC has been investing heavily in fintech integration, mobile banking, and digital wealth platforms. These efforts are paying off by improving efficiency, reducing operational costs, and enhancing customer experience. In turn, these improvements contribute to investor confidence, positively influencing the share price.

Future Outlook: Where Could the HSBC Share Price Go Next?

Looking ahead, the HSBC share price will likely continue to be shaped by three major themes: global interest rates, Asian market expansion, and technological adaptation. As long as interest rates remain elevated, the bank’s core earnings from lending activities should stay strong. However, if central banks begin cutting rates to combat slowing growth, that could slightly pressure margins.

The bank’s ongoing pivot toward Asia remains a long-term growth driver. With China’s economic recovery, Hong Kong’s renewed financial activity, and rising demand for wealth management services in Asia, HSBC is positioned to capture significant opportunities. The challenge, however, will be managing geopolitical risk, especially as Western and Chinese relations continue to fluctuate.

Finally, the digital revolution in banking will play a crucial role. HSBC’s ability to innovate, streamline operations, and compete with fintech disruptors will determine how investors value it in the coming decade. A bank that adapts successfully to technology-driven finance could see a substantial re-rating of its share price over time.

Investor Considerations and Risk Factors

For anyone considering investing in HSBC shares, it’s important to balance the potential rewards with the risks. On the positive side, HSBC offers a rare combination of scale, diversification, and dividend yield. Its strong presence in Asia gives it access to fast-growing economies and lucrative financial markets. For long-term investors seeking exposure to global banking, HSBC represents a compelling choice.

However, risks do exist. Currency fluctuations can affect earnings when profits from Asia are converted into pounds. Geopolitical instability, especially concerning China or Hong Kong, could influence both regulatory oversight and investor sentiment. Additionally, competition from nimble fintech companies and evolving customer preferences may require constant innovation.

Another consideration is ESG (Environmental, Social, and Governance) performance. As sustainability becomes a major factor in institutional investing, HSBC’s initiatives in green finance and responsible banking will also play a role in attracting or deterring investors. The bank has already made commitments to net-zero targets and sustainable financing, which may positively influence long-term perception.

Conclusion: The Enduring Strength of HSBC Shares

The HSBC share price tells a story of resilience, adaptability, and global significance. Over more than a century, the bank has weathered financial crises, regulatory upheavals, and geopolitical turbulence — yet continues to stand as one of the most trusted names in banking. While the path forward will include challenges, particularly in managing East-West tensions and embracing digital transformation, the bank’s strategic direction appears solid.